Introduction

Importance of fast and accurate loan processing

As the lending industry continues to evolve, the demand for faster and more accurate loan processing has become increasingly important. That’s where OCR (optical character recognition) comes in – a technology that has the potential to revolutionize the way loans are processed.

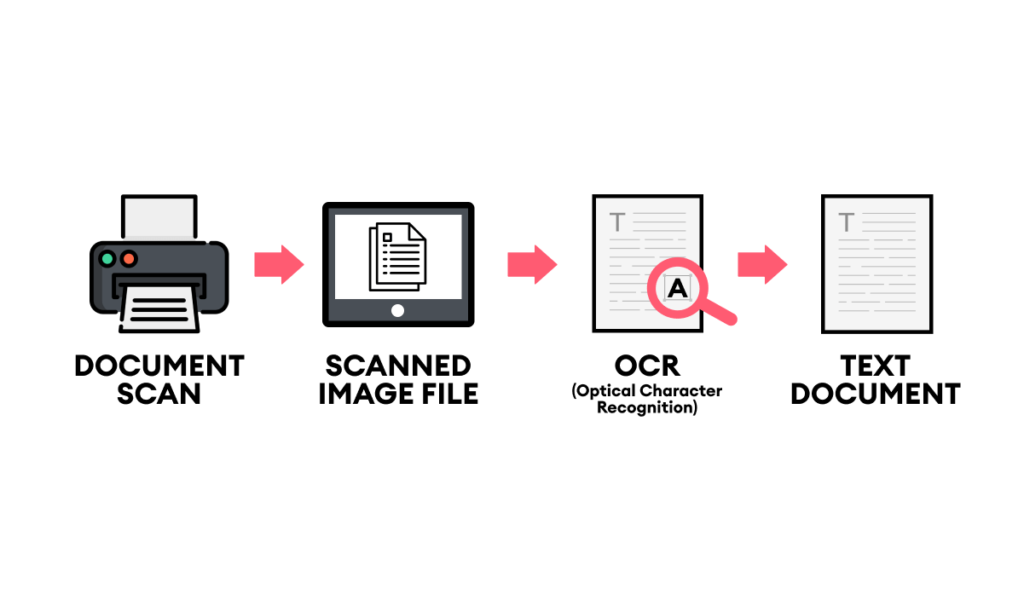

Introduction to OCR technology

So, what exactly is OCR? Simply put, it’s a technology that converts printed or handwritten text into digital data that can be easily read and processed by a computer. In the context of loan processing, OCR can be used to extract relevant information from loan documents such as income statements, tax returns, and credit reports.

Speeding Up Loan Processing

Improving Accuracy in Loan Processing with OCR

Loan processing is speed – With OCR, lenders can process loan applications much more quickly and efficiently than if they were manually reviewing each document. This not only saves time, but it also reduces the risk of errors and inaccuracies that can occur with manual processing.

Benefits of faster loan processing with OCR

Loan processing accuracy – OCR technology is incredibly precise, with the ability to recognize and extract text even from handwritten documents. This means that lenders can be more confident in the accuracy of the data they are using to make lending decisions, which can ultimately lead to better loan outcomes for both lenders and borrowers.

Enabling New Forms of Lending

Ability to enable new forms of lending – For example, with OCR, lenders can more easily process and analyze large volumes of data from non-traditional sources such as social media profiles or online marketplaces. This has the potential to expand access to credit for individuals who may not have a traditional credit history.

Conclusion

Overall, OCR is a technology that has the potential to revolutionize the way loans are processed. With its ability to speed up processing, improve accuracy, and enable new forms of lending, OCR is quickly becoming a must-have technology for lenders who want to stay competitive in the lending industry.

Click here to learn how many type of loans and understand your financing options.